WeStreet en Español

Es Donde Perteneces

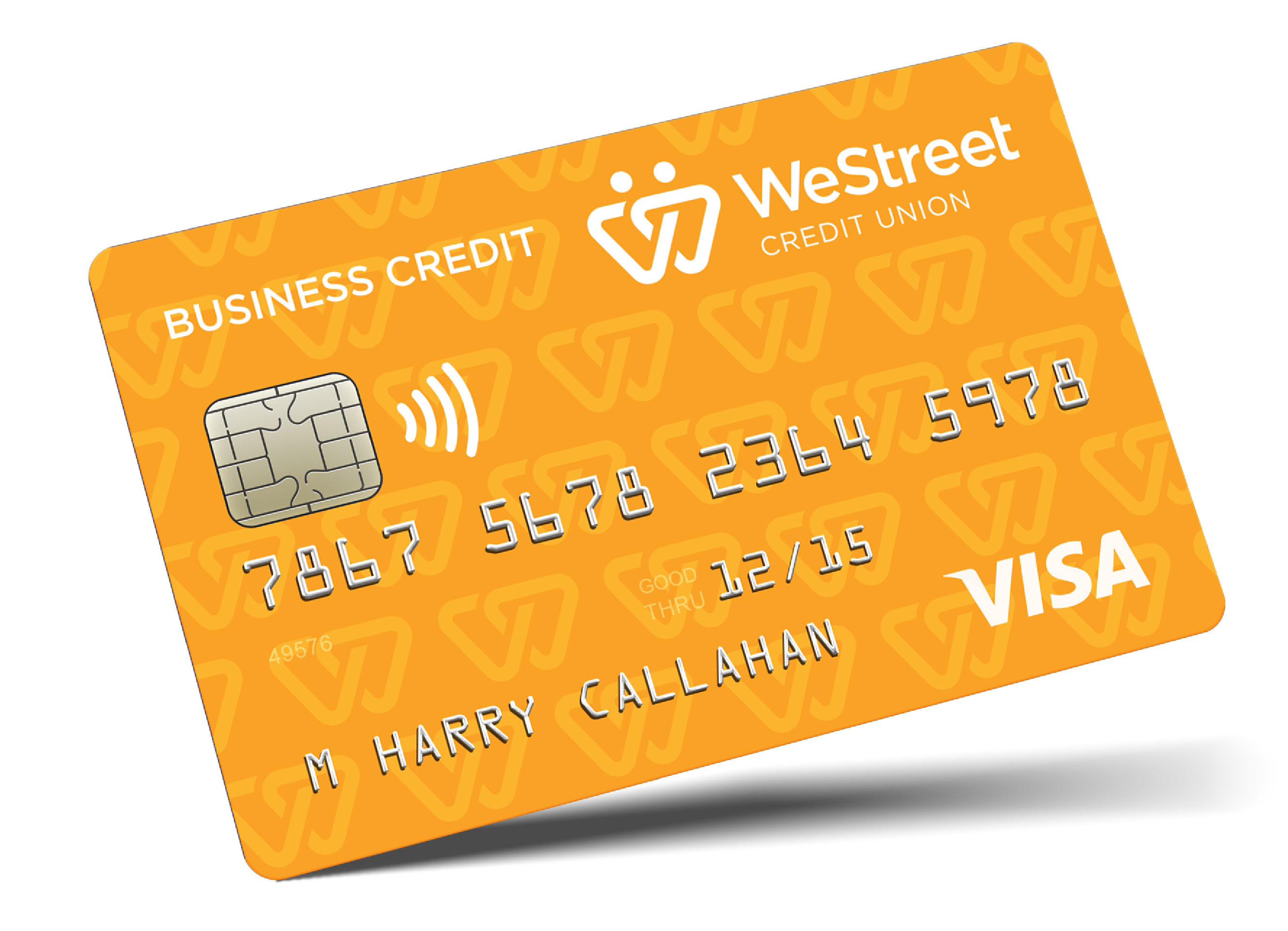

Descubre la Iniciativa Hispana de WeStreet: un espacio creado especialmente para ti. Nuestra página en español ofrece educación financiera y detalles sobre nuestros productos y servicios.

Discover WeStreet in Spanish: a space created especially for you. Our website in Spanish offers financial education and details about our products and services.

westreet español