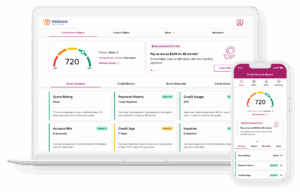

Five major categories make up a credit score:

40% Payment History: Essentially, lenders want to know whether you’re good about paying your loans on time.

23% Credit Usage: Credit usage, also known as credit utilization, is the ratio between the total credit used and your total credit limit on your revolving accounts. It is best to keep your credit usage below 30%.

21% Credit Age: The average of your oldest open credit accounts to your newest open credit accounts determines your credit age. In general, the longer your credit history the better, particularly accounts with a good payment history and no late payments.

11% Credit Mix: It’s important to have a mix of different types of credit like revolving credit and installment loans. Your score will likely be higher if you have a good payment history with both, installment loans, like student loans and mortgages, and revolving credit, like credit cards.

5% Inquiries: Any time you apply for a credit card, or a lender checks your credit for a loan, it’s known as an inquiry. Hard inquiries show on your credit report when your credit is pulled by a lender for a car loan, mortgage, or credit card. However, soft inquiries don’t show on your credit report and occur when you check your credit, or a lender pre-approves you for an offer.

Applying for several credit cards or opening multiple credit accounts in a short period creates hard inquiries and could signal an increased credit risk to a lender.